introduction:

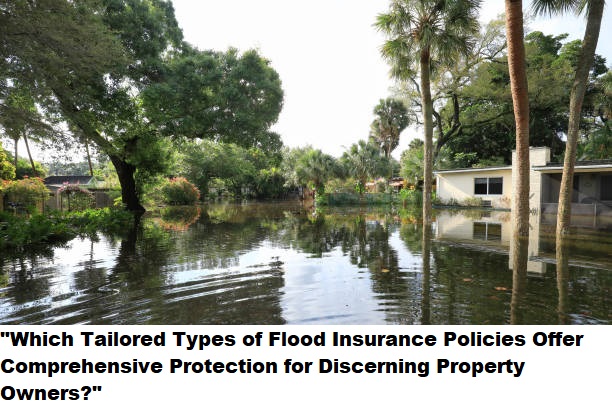

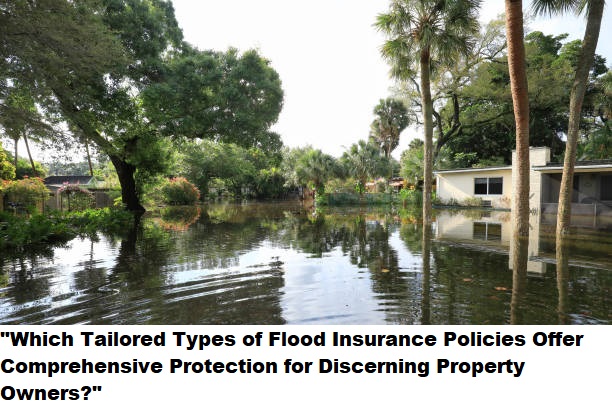

In this article, we unravel the compelling reasons behind the escalating prominence of private flood insurance as an increasingly viable and flourishing alternative to coverage provided by the National Flood Insurance Program (NFIP). As homeowners navigate the shifting landscape of flood protection, understanding the distinct advantages offered by private insurers becomes pivotal in making informed and tailored choices for safeguarding their properties.

- 1. Customized Policies Tailored to Individual Property Characteristics and Risks

- 2. Competitive Premiums and Flexible Coverage Options Beyond NFIP Constraints

- 3. Innovative Technology for Accurate Risk Assessment and Timely Claim Processing

- 4. Higher Coverage Limits Providing Enhanced Financial Protection for Policyholders

- 5. Expedited Claims Processing and Improved Customer Service Experience

- 6. Adaptability to Evolving Market Trends and Changing Flood Risk Dynamics

Customized Policies Tailored to Individual Property Characteristics and Risks:

Private flood insurance distinguishes itself by offering customized policies tailored to the unique characteristics and risks of individual properties. Unlike the one-size-fits-all approach of NFIP, private insurers leverage detailed assessments to tailor coverage, considering factors such as property elevation, construction materials, and specific flood risks. This customization ensures that homeowners receive precisely the coverage they need, optimizing protection and aligning with the distinctive features of their properties.

Competitive Premiums and Flexible Coverage Options Beyond NFIP Constraints:

One of the compelling reasons for the growing preference for private flood insurance is the competitive premiums and flexible coverage options it provides, surpassing the constraints often associated with NFIP. Private insurers operate in a competitive market, offering a range of coverage choices tailored to diverse budgets and preferences. This flexibility allows homeowners to choose coverage that suits their financial capacity while enjoying the benefits of enhanced protection beyond what NFIP might provide. The ability to tailor coverage based on individual needs contributes to the attractiveness of private insurers in the flood insurance landscape.

Innovative Technology for Accurate Risk Assessment and Timely Claim Processing:

Private flood insurers leverage innovative technology for accurate risk assessment, enhancing their ability to evaluate and price flood risks with precision. Advanced tools such as satellite imagery, geospatial mapping, and predictive analytics enable insurers to conduct thorough risk assessments, ensuring that coverage aligns closely with actual flood vulnerabilities. Additionally, the use of technology streamlines claim processing, facilitating quicker and more efficient resolutions for policyholders. This technological edge contributes to the appeal of private flood insurance, as homeowners seek not only accurate risk evaluation but also a streamlined and responsive claims experience.

Higher Coverage Limits Providing Enhanced Financial Protection for Policyholders:

Private flood insurance often offers higher coverage limits, providing policyholders with enhanced financial protection against the potentially devastating impacts of floods. Unlike the predetermined limits set by NFIP, private insurers allow homeowners to secure coverage that more closely matches the value of their properties and possessions. This higher coverage mitigates the risk of underinsurance and ensures that policyholders have the financial resources needed for comprehensive recovery in the aftermath of a flood event. The appeal of higher coverage limits is a significant factor driving the increasing popularity of private flood insurance.

Expedited Claims Processing and Improved Customer Service Experience:

Private flood insurers prioritize expedited claims processing and a superior customer service experience, addressing common pain points associated with traditional insurance programs like NFIP. By focusing on efficiency and responsiveness, private insurers aim to minimize the stress and delays often experienced during the claims process. Homeowners appreciate the quicker resolution of claims, contributing to an overall positive customer service experience. The emphasis on customer satisfaction and efficient claims processing distinguishes private flood insurance providers as customer-centric alternatives in the market.

Adaptability to Evolving Market Trends and Changing Flood Risk Dynamics:

Private flood insurance exhibits adaptability to evolving market trends and changing flood risk dynamics, allowing insurers to stay ahead of emerging challenges. In contrast to the relatively static nature of government-backed programs like NFIP, private insurers can swiftly respond to shifts in the insurance landscape, incorporating new technologies, adjusting coverage options, and refining risk assessment methodologies. This adaptability ensures that policyholders benefit from the latest advancements in flood risk management, making private insurance a dynamic and forward-thinking choice for homeowners navigating the unpredictable nature of flood risks.

Conclusion:

In conclusion, the emergence of private flood insurance as a viable and growing alternative to NFIP coverage can be attributed to its ability to offer tailored, competitive, and technologically advanced solutions. Customized policies that consider individual property characteristics and risks provide homeowners with precise coverage, addressing the limitations of standardized approaches. Competitive premiums and flexible coverage options surpass the constraints of NFIP, offering homeowners a range of choices. The integration of innovative technology ensures accurate risk assessment and timely claims processing, enhancing the overall insurance experience. Higher coverage limits, expedited claims processing, and adaptability to evolving market trends further contribute to the appeal of private flood insurance. I hope this exploration sheds light on the multifaceted advantages driving the increasing prominence of private flood insurance, empowering homeowners to make informed choices in safeguarding their properties.